pa auto sales tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Some counties impose additional surtaxes however.

Pennsylvania Sales Tax Small Business Guide Truic

You can find these fees further down on the page.

. Pennsylvania Vehicle Registration Taxes Fees. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax. 425 Motor Vehicle Document Fee.

72201-1400 is sample zip code for Look-up Tool. The city of Philadelphia imposes an additional two percent raising the rates in that city. In addition to taxes car purchases in Pennsylvania may be subject to other fees like registration title and plate fees.

Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be. The use tax rate is the same as the sales tax rate. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

For vehicles that are being rented or leased see see taxation of leases and rentals. To find out more about our finance specials please feel free to. According to the.

Then use this number in the multiplication process. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. 65 county city rate on 1st 2500.

View pg 1 of chart find total for location. Exact tax amount may vary for different items. Our free online Pennsylvania sales tax calculator calculates exact sales tax by state county city or ZIP code.

The sales and use tax is imposed on the retail sale consumption rental or use of tangible personal property including - digital products - in Pennsylvania. If you trade in a vehicle only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed. Try our FREE income tax calculator.

Assistant labour commissioner training. Use tax is the counterpart of the state and local sales taxes. Select Community Details then click Economy to view sales tax rates.

Pennsylvania sales tax calculator Table Booking. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and. Mortgage Loan Auto Loan Interest Payment Retirement.

How to Calculate Sales Tax. Showing posts with the label pennsylvania car sales tax calculator. View chart find city rate find county rate apply car tax rate formula.

Some dealerships may also charge a 113 dollar document preparation charge. Your household income location filing status and number of personal exemptions. A sales tax is a consumption tax paid to a government on the sale of.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. You can find these fees further down on the. Find your state below to determine the total cost of your new car including the car tax.

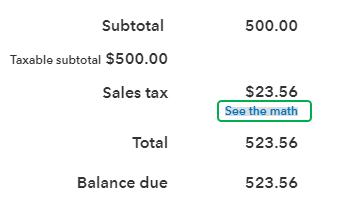

Enter the sales tax percentage. 26 rows Select location. Before-tax price sale tax rate and final or after-tax price.

The jurisdiction breakdown shows the different tax rates that make up the combined rate. 30000 8 2400. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Passenger vehicle traction law. For example the rate in Allegheny County is seven percent and that in Philadelphia County is eight percent. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. Find list price and tax percentage. Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of.

Divide tax percentage by 100 to get tax rate as a decimal. You can find these fees further down on the page. Fha waiting period notice.

Call PA Auto Sales Today Take advantage of our current finance deals to lock in savings today. 56 county city. Multiply the net price of your vehicle by the sales tax percentage.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Multiply the price of your item or service by the tax rate. The PA sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price.

Start filing your tax return now. Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. The Pennsylvania PA state sales tax rate is currently 6.

2022 Pennsylvania state sales tax. TAX DAY NOW MAY 17th - There are -373 days left until taxes are due. The state sales tax rate for leasing a motor vehicle in Pennsylvania is six percent.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. 6 percent state. These fees are separate from the taxes and DMV.

612 Rosser Ave Brandon MB R7A OK7. Remember to convert the sales tax percentage to decimal format. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166 on.

When Pennsylvania sales tax is not charged by the seller on a taxable item or service delivered into or used in Pennsylvania the consumer is required by law to report and remit use tax to the Department of Revenue. Showing posts with the label pennsylvania car sales tax calculator. The jurisdiction breakdown shows the different tax rates that make up the combined rate.

Most profitable crops stardew spring. The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Hvac system in pharmaceutical industry slideshare. Any vehicle thats designed to be used on the highway whether its a sedan boat trailer camper or even a mobile home is subject to sales tax because it is personal property. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

What Is Pennsylvania Pa Sales Tax On Cars

Trade It Junk It Or Give It To Charity Car Trade Car Buying Tips Car

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Understanding California S Sales Tax

What S The Car Sales Tax In Each State Find The Best Car Price

Arkansas Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Register For A Sales Tax Permit Taxjar

What S The Car Sales Tax In Each State Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How Do State And Local Sales Taxes Work Tax Policy Center

Pennsylvania Sales Tax Guide For Businesses

What S The Car Sales Tax In Each State Find The Best Car Price

How Is Tax Liability Calculated Common Tax Questions Answered